MARKETS CHOPPY. IF THE FED CUTS INTEREST RATE BY 50 BPS, THEN THE MARKET AND RATE SENSITIVES WILL GET A BOOST.

SENSEX RESISTANCE AT 18033-18491-18670. SUPPORT AT 17927-17443-16951.

NIFTY RESISTANCE AT 5257-5360-5403. SUPPORT AT 5142-5071-4900.

Thursday, January 31, 2008

: Daily Market Outlook : 31st January, 2008 (Thursday)

Posted by Market Analysis at 12:45 PM 0 comments

Labels: 31-Jan-2008, Share Market

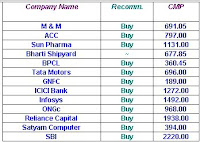

Premium Market

IPO Allotment

(1) Future Capital: 8 shares to 6 : 19 (Applied for 128 Shares)

(2) Reliance power 15 shares may be allotted against applied for 225 shares

Posted by Market Analysis at 12:43 PM 0 comments

Labels: 31-Jan-2008, Premium Market, Share Market

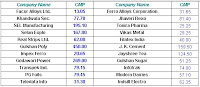

Speculative Scrips

Excellent Performance of our Last Recommendations

(From Intra Day High Rate)

SEL Man. (+19), Infotrak (+2), Indisil Electro (+2), Teledata (+1), J. K. Cement (+4)

Posted by Market Analysis at 12:41 PM 0 comments

Labels: 31-Jan-2008, Share Market, Speculative Scrips

Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

Sujana Universal (+2), Surya Pharma (+4), Karutur Network (+2), Sail (+2),

Mcleod Russel (+4), Kirloskar Electrics (+5)

Posted by Market Analysis at 12:38 PM 0 comments

Labels: 31-Jan-2008, Share Maket Funda-Picks, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

BOB (+3), TCI (+20)

Posted by Market Analysis at 12:34 PM 0 comments

Labels: 31-Jan-2008, Share Market, Technical Share

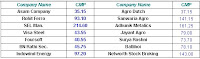

Share Market Stock-Watch

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

Bharti (8), GVK Power (27), JSW Steel (32), Godrej (16), India Cement (13),

Asian Paint (3), Voltam (12)

Posted by Market Analysis at 12:32 PM 0 comments

Labels: 31-Jan-2008, Share Market, Share Market Stock-Watch

Share-Market-Tips

Posted by Market Analysis at 12:28 PM 0 comments

Labels: 31-Jan-2008, Share Maket Funda-Picks, Share Market Tips

Federal Reserve Cut Half Point

Half Point Cut

by Jeffrey Cane Jan 30 2008

As economy grinds to a halt, what's next for the Fed?  Federal Reserve policymakers lowered their benchmark interest rate by a half point, to 3 percent, pointing to "a deepening of the housing contraction as well as some softening in labor markets."

Federal Reserve policymakers lowered their benchmark interest rate by a half point, to 3 percent, pointing to "a deepening of the housing contraction as well as some softening in labor markets."

"Financial markets remain under considerable stress, and credit has tightened further for some businesses and households," the Fed said.

The statement left the door open to further rate cuts if needed, with the Fed saying it "will act in a timely manner" if it sees further risks to economic growth."

Stocks, which had modest losses before the announcement, turned sharply higher. The Dow Jones industrial average was up 1 percent minutes after the Fed cut. Treasury prices and the dollar weakened.

The move comes eight days after the Fed surprised investors with a three-quarter-point cut, citing "a weakening of the economic outlook and increasing downside risks to growth." It was the first rate cut to take place between meetings of Fed policymakers since September 2001, when the central bank acted in the aftermath of the terrorist attacks.

The January rate cuts represent the most aggressive action by the central bank since 1990. (See a chart of the Fed's benchmark rate here.)

Still, as Greg Ip of the Wall Street Journal points out, the Fed's statement serves as a reminder of "how much it has already done" as well as a declaration that it stands ready to act again.

"Today’s policy action, combined with those taken earlier, should help to promote moderate growth over time and to mitigate the risks to economic activity," the Fed said today.

Today's economic data underscored the need for aggressive action. The Commerce Department reported today that the economy grew at an annual pace of 0.6 percent in the last three months of 2007, the slowest growth in five years, when the economy was just emerging from a recession. The advance gross domestic product estimate was nearly half analysts' forecasts. In the third quarter, the economy grew at a 4.9 percent annual pace.

"The G.D.P. hit stall speed," wrote Joseph Brusuelas, chief U.S. economist at IDEAglobal, according to MarketWatch.

Floyd Norris of the New York Times notes on his blog that the G.D.P. report showed that spending on nondurable consumer products other than food and energy was down in the quarter, after adjusting for inflation. "Put that down as another recession warning," he says.

There was one dissent to today's rate cut: Richard W. Fisher, president of the Federal Reserve Bank of Dallas, who preferred no change in the target for the federal funds rate at this meeting.

What next for the Fed? The market is already pricing in another quarter point cut when Fed policymakers meet next, on March 18. Some see the rate going as low as 2.25 or even 2 percent by the end of the year.

For the time being, however, as the Economist's View blog says, "Hopefully, though, we can now all catch our breaths for a little while and get a better assessment of exactly where we are."

Posted by Market Analysis at 9:54 AM 0 comments

Labels: Share Market, USA Stock Exchange

Free Indian Stock Day Trading Tips : 31- Jan - 2008

Daily Stock Watch ::

1. Recap: RCOM gave a profit of Rs 26/-, GMR Infra gave a profit of Rs 3.5/-, Infosys gave a profit of rs 11/- and Bank of India did not reach the entry price.

2. Indian Stock market Direction Free Tips: Market in a range bound territory. US Fed rate and derivatives expiry to determine the exact trend of the market. Till than market to trade in a narrow trading range Nifty 5000-5400.

3. Stock market Diary:The market had a lot to digest today - poor global cues ahead of tonight's US Fed meet, F&O expiry session and RBI's unchanged policy yesterday - and ended weak. The European markets too were weighed down due to subprime fears. Sensex closed at 17758, down 333 points and Nifty at 5167, down 113 points from the previous close. The CNX Midcaps Index was down 2.4% and BSE Smallcaps Index was down 2.2%. The BSE Oil& Gas Index was down 4.4%. The market breadth was negative with advances at 261 against declines of 949 on the NSE. Top Nifty gainers included BHEL, SAIL, Tata Steel and ACC while losers included Suzlon, RPL, Reliance Energy and ONGC.

4. Strong Future Stocks

Karnataka Bank

Sterling Bio

PNB

Indian Bank

Hero Honda

Tata Tea

HDFC

Shree Cem

Sun Pharma

UBI

5. Weak Future Stocks

Escorts

MRPL

Strides Arco

TVS

Arvind Mills

Chambal Fert

Neyveli

Nagarjuna fert

JPAsso

Peninsula Land

6. Free Indian Stock Day Trading Tips:

Buy ONGC>996,999,1032,1096 sl 988 (Stock can be held as delivery)

Buy ITC>201.5,209 sl 198.8

Buy GMR Infra>180.2,186,195 sl 176

Buy Infosys.1493.1,1512,1530 sl 1488

Posted by Market Analysis at 9:48 AM 0 comments

Labels: 31-Jan-2008, Share Market

Wednesday, January 30, 2008

: Daily Market Outlook : 30th January, 2008 (Wednesday)

MARKETS WILL REMAIN CHOPPY AND VOLATILE TO SAY THE LEAST. SELLING PRESSURE VISIBLE AT 4400 NIFTY. BE CAUTIOUS AND REDUCE TRADE.

SENSEX RESISTANCE AT 18246-18491-18670-18930. SUPPORT AT 17927-17443-16951.

NIFTY RESISTANCE AT 5329-5360-5403-5540. SUPPORT AT 5225-5071-4900.

Posted by Market Analysis at 10:14 AM 0 comments

Labels: 30-jAN-2008, Share Market

Premium Maret

Posted by Market Analysis at 10:11 AM 0 comments

Labels: 30-jAN-2008, Premium Market, Share Market

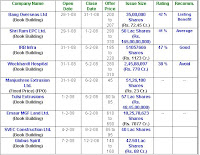

New Public Issue ( IPO )

Posted by Market Analysis at 10:05 AM 0 comments

Labels: 30-jAN-2008, New Public Issue ( IPO ), Share Market

Share Market Stock-Watch

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

Suzlon (+24), Bartronics (+4), Ingersoll Rand (+5), RIL (+3), Indiabulls (+3), Deccan Ch. (+6), Rajesh Export (+10), Godfree Phillips (+15), Guj. NRE Coke (+4), Cairn India (+26),

Aban Offshore (+90), Great Offshore (+75), Yes Bank (+2)

Posted by Market Analysis at 10:02 AM 0 comments

Labels: 30-jAN-2008, Share Market, Share Market Stock-Watch

Speculative Scrips

Excellent Performance of our Last Recommendations

(From Intra Day High Rate)

SKP (+1), Mangalam Cement (+4), VBC Ind. (+1), Manaksia Ltd. (+3), Fortune Finane (+5),

W.S. Ind. (+5), Guj. Siddhee Cement (+5)

Posted by Market Analysis at 9:58 AM 0 comments

Labels: 30-jAN-2008, Share Market, Speculative Scrips

Share Maket Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

Indsill Electro (+2), Jindal Worldwide (+18), Steel Strips (+5), Arvind (+2), GHCL (+4),

Dena Bank (+3), Vijaya Bank (+2), Sadbhav Engg. (+4), PFC (+2), West Cost Paper (2_,

GVK Power (3), PFC (+2), PTC (+2)

Posted by Market Analysis at 9:56 AM 0 comments

Labels: 30-jAN-2008, Share Maket Funda-Picks, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

TCS (+6), Bajaj Auto (+3), SBI (+19), Tata Motors (+2), Cipla (+11),

Central Bank (+3), Dabur (+7), G.E. Shipping (+7), Karur Vysya Bank (+8),

Triveni Engg. (+49), ONGC (+17)

Posted by Market Analysis at 9:54 AM 0 comments

Labels: 30-jAN-2008, Share Market, Technical Share

Share Market Tips

Posted by Market Analysis at 9:51 AM 0 comments

Labels: 30-jAN-2008, Share Market, Share Market Tips

Tuesday, January 29, 2008

: Daily Market Outlook : 29th January, 2008 (Tuesday)

Reliance Power Form's Premium Rs. 100

Posted by Market Analysis at 9:59 AM 0 comments

Labels: 29-Jan-2008, Share Market

Premium Market

Posted by Market Analysis at 9:58 AM 0 comments

Labels: 29-Jan-2008, Premium Market, Share Market

New Public Issue ( IPO )

Posted by Market Analysis at 9:51 AM 0 comments

Labels: 29-Jan-2008, New Public Issue ( IPO ), Share Maket Funda-Picks

Share Market Stock-Watch

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

IL&FS Invest (+21) RIL (+185), M & M (+53), PBA Infra (+5), BHEL (+75),

Areva T & D (+188), Bharat Electronics (+128), REL (+212), L & T (346),

Indiabulls Real Estate (+83), ICRA (+4),

Posted by Market Analysis at 9:49 AM 0 comments

Labels: 29-Jan-2008, Share Market, Share Market Stock-Watch

Speculative Scrips

Excellent Performance of our Last Recommendations

(From Intra Day High Rate)

South Iron & Steel (+2), Nitco Tile (+8), Datamatics Techno (+2), Modicon (+2), Mascon Capital (+1),

Atul Ltd. (+5), Ghandhi Tube (+3), Emkay Shares (+7), NCL Ind. (+3), Zenith Fiber (+2),

Posted by Market Analysis at 9:47 AM 0 comments

Labels: 29-Jan-2008, Share Market, Speculative Scrips

Share Maket Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

Jyoti Structure (+14), UCO Bank (+3), GIPCL (+4), Chennai Petro (+35), TFC (+2), GHCL (+19),

Rolta (+8), Marg Construction (+21), RPL (+12), RNRL (+14), State Trading Corp. (+4),

Century Ply. (+4), GTL (+4), Jindal Poly (+12), Redington (+14), Pidilite (+3),

Posted by Market Analysis at 9:46 AM 0 comments

Labels: 29-Jan-2008, Share Maket Funda-Picks, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

ICICI Bank (+50), ONGC (+67), R.Com (+38), Dishman Pharma (+2),

Patni Computer (+36) Biocon (+24), Bank of Raj. (+4), Hero Honda (+58),

ITC (+19), NDTV (+36), Idea Cellular (+6), Dr. Reddys Labs (+47)

Posted by Market Analysis at 9:44 AM 0 comments

Labels: 29-Jan-2008, Share Market, Technical Share

Share Market Tips

Posted by Market Analysis at 9:27 AM 0 comments

Labels: 29-Jan-2008, Share Market, Share Market Tips

Monday, January 28, 2008

: Daily Market Outlook : 28th January, 2008 (Monday)

Daily Market News & Analysis.

Reliance Power : Form's Premium Rs. 100.

NIFTY HAS REACHED THE CORRECTION LEVEL AND MAY COME DOWN FROM THERE.

BE CAREFUL AND CAUTIOUS WHILE TRADING.

SENSEX RESISTANCE 18919-19054-19624. SUPPORT AT 17810-17576-17277.

NIFTY RESISTANCE AT 5403-5628-5857. SUPPORT AT 5277-5146-4891.

Posted by Market Analysis at 9:56 AM 0 comments

Labels: 28-Jan-2008, Share Maket Funda-Picks

Premium Market

Posted by Market Analysis at 9:55 AM 0 comments

Labels: 28-Jan-2008, Premium Market, Share Maket Funda-Picks

New Public Issue ( IPO )

Posted by Market Analysis at 9:53 AM 0 comments

Labels: 28-Jan-2008, New Public Issue ( IPO ), Share Maket Funda-Picks

Speculative Scrips

Excellent Performance of our Last Recommendations

(From Intra Day High Rate)

Datamatics Techno (+2), BRFL (+8), Shriram Transport Finance (+3),

Modicon (+2), Mascon Capital (+1), Atul Ltd. (+5), Ghandhi Tube (+3), Emkay Shares (+7),

NCL Ind. (+3), Zenith Fiber (+2), Andhra Cement (+1), South Iron & Steel (+2), Nitco Tile (+8)

Posted by Market Analysis at 9:50 AM 0 comments

Labels: 28-Jan-2008, Share Maket Funda-Picks, Speculative Scrips

Share Market Stock-Watch

The outlook of the markets

may be volatile

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

M & M (+53), PBA Infra (+5), BHEL (+75), Reliance Capital (+285), Adani Enterprise (+44),

Areva T & D (+188), Bharat Electronics (+128), REL (+212), L & T (346), Rolta (+9),

Indiabulls Real Estate (+83), ICRA (+4), Zee News (+4), IL&FS Invest (+21) RIL (+185)

(From Intra day High Rate)

M & M (+53), PBA Infra (+5), BHEL (+75), Reliance Capital (+285), Adani Enterprise (+44),

Areva T & D (+188), Bharat Electronics (+128), REL (+212), L & T (346), Rolta (+9),

Indiabulls Real Estate (+83), ICRA (+4), Zee News (+4), IL&FS Invest (+21) RIL (+185)

Posted by Market Analysis at 9:47 AM 0 comments

Labels: 28-Jan-2008, Share Maket Funda-Picks, Share Market Stock-Watch

Share Maket Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

GIPCL (+4), Chennai Petro (+35), TFC (+2), GHCL (+19), REI Agro (+4), Bongaigaon Ref. (+4),

Rolta (+8), Marg Construction (+21), RPL (+12), RNRL (+14), State Trading Corp. (+4),

Century Ply. (+4), GTL (+4), Jindal Poly (+12), Redington (+14), Pidilite (+3),

ING Vysya Bank (+12), Jyoti Structure (+14), UCO Bank (+3)

Posted by Market Analysis at 9:44 AM 0 comments

Labels: 28-Jan-2008, Share Maket Funda-Picks, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

ICICI Bank (+50), ONGC (+67), R.Com (+38), Dishman Pharma (+2),

Patni Computer (+36) Biocon (+24), Bank of Raj. (+4), Hero Honda (+58),

ITC (+19), NDTV (+36), Idea Cellular (+6), Dr. Reddys Labs (+47)

Posted by Market Analysis at 9:42 AM 0 comments

Labels: 28-Jan-2008, Share Market, Technical Share

Share Market Tips

Posted by Market Analysis at 9:29 AM 0 comments

Labels: 28-Jan-2008, Share Market, Share Market Tips

Friday, January 25, 2008

Fed says was unaware of SocGen losses

Washington/Chicago, Jan 25: The Federal Reserve, when it decided on an emergency interest rate cut this week, was unaware of a scandal involving a rogue trader that led to about USD 7 billion in losses at France's Societe Generale, a Fed official said on Thursday.

Still, the heavy losses at SocGen, France's second-biggest bank, dealt a blow to the Fed's credibility in the eyes of some financial market participants, who wondered if policy-makers blundered in making the biggest US interest rate cut in a generation on Tuesday.

"Their panicky rate cut was not to insure the smooth functioning of the markets, but rather, to guarantee prices," said Barry Ritholtz, a market analyst at Ritholtz Research & Analytics.

"We quickly learn what sheer folly and utter irresponsibility it is for the Fed to use its limited ammunition to intervene in equity prices," Ritholtz wrote on his blog, The Big Picture.

The US central bank on Tuesday morning stunned markets by slashing overnight borrowing costs by three-quarters of a percentage point, to 3.5 percent. The cut came a day after a global stocks rout and just a week ahead of the Fed's next scheduled policy meeting. US markets, closed on Monday for a holiday, were set to reopen when the Fed acted.

Initially, analysts attributed the swoon in global markets exclusively to worries about the possibility of a global meltdown triggered by mounting US economic problems. But on Thursday, after SocGen said it had tried to close out rogue positions on Monday, some analysts said the bank's sales may have played a big role in the day's sell-off.

The re-evaluation led traders to ratchet back expectations for another big rate reduction at the US central bank's January 29-30 policy meeting.

The SocGen blowup "suggests more big rate cuts near term might not be so necessary," said strategists at Action Economics.

The chances of a half-point rate cut, as implied by interest-rate futures prices, fell as low as 58 percent after being fully priced in late on Wednesday.

CHANGE IN RATE PATH?

Even though the losses at SocGen have come to light, the Fed official, who spoke on the condition of anonymity, said policy-makers remain comfortable with their decision to cut rates aggressively.

When policy-makers held an emergency video-conference on Monday night, they felt financial market volatility, including, but not limited to, broad stock market declines on Monday, reflected underlying concerns about the broad economy, the official said. They did not consider the volatility to be due to the problems of any single institution, the official added.

Policy-makers were clear at their meeting that the benchmark federal funds rate was higher than they wanted, the official said. The risks of waiting for the next scheduled policy meeting before acting outweighed the downside of any criticism the Fed might incur for an inter-meeting change that could be seen as a response to market events, the official added.

Fed officials were convinced the sizable rate cut so close to a scheduled meeting would make clear to markets the US central bank's willingness to address the most serious risks, the official said.

Ref: www.zeenews.com

Posted by Market Analysis at 2:36 PM 0 comments

Labels: 25-Jan-2008, USA Stock Exchange

NYSE agrees to acquire rival American stock exchange

New York, Jan 18: The New York Stock Exchange has agreed to buy the American Stock Exchange, ending a once intense rivalry that began in colonial times when brokers traded in outdoor markets.

Both exchanges have battled for corporate listings and bragging rights since the early 1900s, with their trading floors just a short walk away from each other in lower Manhattan. Newspapers around the US all listed the stock swings on the nation's two dominant markets, until investors began paying more attention in the 1990s to technology issues on the upstart NASDAQ stock market.

Their evolution took a very different path - with the big board forming NYSE Euronext to become the world's first trans-Atlantic exchange. The AMEX, unable to compete like it once did, began to focus on trading options and other financial products.

The AMEX, which once hosted the likes of big-name stocks such as the New York Times Co and the Washington Post Co, now trades generally smaller companies that are often too illiquid to meet the standards of bigger rivals.

NYSE Euronext said it would pay AMEX's seat-holders, which are generally members that trade at the exchange, USD 260 million in stock. In addition, they would receive more stock after the sale of the AMEX's landmark building on 86 trinity place - a land-marked art deco building it moved into in 1921 and that sits only blocks away from the World Trade Center site.

The deal will give NYSE Euronext a second US license for an option exchange. It would make the NYSE the no 3 US options market place. The NYSE has been looking to move further into the options business.

Ref : www.zeenews.com

Posted by Market Analysis at 2:31 PM 0 comments

Labels: 25-Jan-2008, USA Stock Exchange

: Daily Market Outlook : 25th January, 2008 (Friday)

MARKETS ARE VOLATILE AND WILL CONTINUE TO EXHIBIT VOLATILITY. TRADERS ARE ADVISED TO STAY AWAY. TRADING IS BEST AVOIDED AS YOUR STOP LOSSES WILL GET TRIGERRED ON BOTH SIDES. SELLING AT HIGHER LEVELS WILL BE SEEN.

SENSEX RESISTANCE AT 17447-17879-17959-18185. SUPPORT AT 16951-16520-15332.

NIFTY RESISTANCE AT 5113-5245-5357. SUPPORT AT 4995-4891-4637-4448.

Posted by Market Analysis at 10:18 AM 0 comments

Labels: 25-Jan-2008, Share Market

New Public Issue ( IPO )

Posted by Market Analysis at 10:12 AM 0 comments

Labels: 25-Jan-2008, Share Market

Share Market Stock-Watch

The outlook of the markets will be

positive & high volitile

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

3 I Info (+3), Varun Shipping (+3), PVR (+3). HDFC (+116), Marico Ind. (+1),

Sanghvi Movers (+21), Vishal Retail (+3)

Posted by Market Analysis at 10:09 AM 0 comments

Labels: 25-Jan-2008, Share Market

Speculative Scrips

Excellent Performance of our Last Recommendations:

(From Intra Day High Rate)

S. A. Petro (+2), Ankit Metal (+2), Alembic Ltd. (+2)

Posted by Market Analysis at 10:08 AM 0 comments

Labels: 25-Jan-2008, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

Satyam Computer (+8), Bank of Raj. (+2), Idea Cellular (+6)

Posted by Market Analysis at 10:06 AM 0 comments

Labels: 25-Jan-2008, Share Market

Share Maket Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

Dena Bank (+2), Bank of Mah. (+1), Pidilite (+6), PNB (+22), Tulip IT (+20)

Posted by Market Analysis at 10:05 AM 0 comments

Labels: 25-Jan-2008, Share Market

Thursday, January 24, 2008

: Daily Market Outlook : 24th January, 2008 (Thursday)

Daily Market News & Analysis only on Smart Investment

MARKET ACHIEVED ITS FIRST TARGET AS MENTIONED. BUT NOW SELLING WILL BE VISIBLE AT HIGHER LEVELS AND SO VOLATILITY WILL BE MAIN ISSUE.

JUST CHECK UP YESTERDAY'S RECOMMENDATIONS, ALL 100% TARGETS ACHIEVED FOR ALL THE SCRIPTS !!!

FOR TOMORROW, WE FEEL THE MARKET WILL BE VERY VOLATILE AND IT WILL BE SELL ON EVERY RISE STRATEGY.

IF YOU CANNOT SHORT AT HIGHER LEVELS, THEN PLEASE STAY AWAY. PLEASE REMEMBER, IT IS WISE TO SAVE MONEY BY NOT TRADING AT ALL. SOMETIMES NOT TO TRADE BECOMES THE KEY TO SUCCEED.

SENSEX RESISTANCE AT 17804-17997-18269. SUPPORT AT 17471-16951-16650.

NIFTY RESISTANCE AT 5264-5327-5403. SUPPORT AT 5165-5090-4958-4891.

Posted by Market Analysis at 9:51 AM 0 comments

Labels: 24-Jan-2008, Share Market

New Public Issue ( IPO )

Posted by Market Analysis at 9:49 AM 0 comments

Labels: 24-Jan-2008, Share Market

Share Market Stock-Watch

Recovery likely to continue

however global cues may lead to volatility

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

Maruti Suzuki (+27), RIL (+215), L & T (+93), NDTV Network (+11), India Infoline (+113),

BHEL (+141), Kotak Mahindra (+111), Grasim (+150), PVR (+13), Godrej Consumer (+12)

Sun TV (+36), Sesa Goa (+381), LUPIN (+15), Religare (+81), Avaya Global (+43)

Entertainment Network (+10), Easaun Reyroll (+24), Fortis Healthcare (+7)

Posted by Market Analysis at 9:47 AM 0 comments

Labels: 24-Jan-2008, Share Market

Speculative Scrips

Excellent Performance of our Last Recommendations:

(From Intra Day High Rate)

Infotrek (+11), IG Petro (+7), Tips Ind. (+9), A. K. Capital (+20), Guj. Ambuja Export (+4),

IMP Power (+4), Mid Day Multimedia (+4), Nandan Exim (+1), Reliance Chemotex (+2)

Posted by Market Analysis at 9:44 AM 0 comments

Labels: 24-Jan-2008, Share Market

Share Maket Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

NTPC (+27), RNRSL (+25), RPL (+24), Dena Bank (+15), Cen. Bank of Punjab (+4),

Sterlite Techno (+67), Guj. Flurochemicals (+5), Agrotech Foods (+3), Banco Products (+1),

Emppe Dist. (+35), Alps Ind. (+6), Chennai Petro (+22), Bongaigao Ref. (+11),

Panacea Bio (+57), Parrya Agro (+61)

Posted by Market Analysis at 9:42 AM 0 comments

Labels: 24-Jan-2008, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

Satyam Computer (+39), ONGC (+25), TCS (+56), Polaris Software (+19),

Infosys (+38), Bank of India (+16),Tata Motors (+9), ICICI Bank (+31), R.Com. (+39),

Reliance Capital (+145), Bank of Raj. (+11), Bank Of Mah. (+4), Sonata (+3),

ITC (19), REL (+200), Hindalco (+10)

Posted by Market Analysis at 9:37 AM 0 comments

Labels: 24-Jan-2008, Share Market

Wednesday, January 23, 2008

: Daily Market Outlook : 23rd January, 2008 (Wednesday)

US FED CUT WILL INDUCE A SLICE OF LIFE. MARKETS IN PULL BACK MODE.

SENSEX RESISTANCE AT 17576-18269-18962. SUPPORT AT 16650-15920-15382.

Posted by Market Analysis at 10:03 AM 0 comments

Labels: 23-Jan-2008, Share Market

New Public Issue ( IPO )

Posted by Market Analysis at 10:00 AM 0 comments

Labels: 23-Jan-2008, Share Market

Share Market Stock-Watch

Markets may see a recovery &

Relief rally likely following feds big rate cut &

asian markets positive cues

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

Indiabulls Finance (+11), Cairn India (+4), Videocon Ind. (+30),

GMR Infra (+4), Asian Electronics (+21), Dhanus Techno (+10),

Nagarjuna Construction (+8), Godrej Consumer (+2)

Posted by Market Analysis at 9:58 AM 0 comments

Labels: 23-Jan-2008, Share Market

.bmp)

.bmp)

.bmp)

.bmp)

.bmp)

.bmp)