HAVE A GREAT TIME TONITE.

PARTY HARD TO KISS GOODBYE BULLISH 2007 AND WELCOME VERY BULLISH 2008.

MARKETS HAVE REBOUNDED NICELY. IT WILL BE INTERESTING TO SEE, IF THE MARKET IS ABLE TO CROSS AND MAKE A NEW HIGH TODAY OR MAY BE IN THIS WEEK.

LAST FRIDAY MAJORITY OF OUR RECOMMENDATIONS REACHED THEIR TAGETS LIKE EDUCOMP, ALOK TEXT, TATA STEEL, NIIT LTD, BEL & IND HOTEL.

SENSEX RESISTANE AT 20323-20584-21113. SUPPORT AT 20014-19780-1958.

NIFTY RESISTANCE AT 6111-6185-6245. SUPPORT AT 6016-5909-5860.

Monday, December 31, 2007

: Daily Market Outlook:31st December, 2007 (Monday)

Posted by Market Analysis at 10:22 AM 0 comments

Labels: 31-Dec-2007, Share Market

Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

Infotech Enterprise (+3), Spice Communication (+1), Wanbury (+6), Parle Software (+5),

Mah. Seamless (+3), U Flex (+7), Amtek India (+4), Essar Oil (+6), Sona Koya Steearing (+2),

Classic Diamond (+4), Indusind Bank (+5), Power Grid (+1)

Posted by Market Analysis at 10:11 AM 0 comments

Labels: 31-Dec-2007, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

ONGC (+3), Tata Steel (+18), SBI (+11), Hero Honda (+1), Zydus Cadila (+2), CMC (+97),

Bank of Baroda (+16), HDFC Bank (+49), ACC (+3), TCS (+3), REL (+28),

Hindalco (+3), Wipro (+10), IOC (+32)

Posted by Market Analysis at 10:07 AM 0 comments

Labels: 31-Dec-2007, Share Market

Stock-Watch

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

XL Telecom (+27), NMDC (+597), Everonn Systems (+92), RIL (+2), Syngenta India (+4),

Bharat Electronics (+43), JSW Steel (+51), Videocon Ind. (+62)

Posted by Market Analysis at 10:04 AM 0 comments

Labels: 31-Dec-2007, Share Market

Speculative Scrips

Excellent Performance of our Last Recommendations:

(From Intra Day High Rate)

Gemini Communication (+21), Swnwari Agro (+6), ITI Ltd. (+2), SIL Investment (+5), Jhunjhunwala Vanaspati (+9), Inducto Steel (+2), VLS Finance (+2), Rajeshwari Foundation (+1), VBC Ind. (+1), Yashraj Security (+1), S.Kumar Nat. (+3), Deccan Gold (+5),

Posted by Market Analysis at 9:46 AM 0 comments

Labels: 31-Dec-2007, Share Market

Friday, December 28, 2007

: Daily Market Outlook:28th December, 2007 (Friday)

ROLLOVERS WERE STRONG.

SOME STOCKS TO WATCH OUT IN THE NEXT MONTH ARE HINDALCO, RPL AND ARVIND.

YESTERDAY RENUKA, PUNJ LLOYD, REL, IOC, TATA POWER, TATA CHEM,

GE SHIPPING AND STERLITE IND REACHED THEIR TARGETS.

SENSEX RESISTANCE AT 20323-20498-20827. SUPPORT AT 20159-20014-19940.

NIFTY RESISTANCE AT 6111-6185-6274. SUPPORT AT 6060-6025-5985.

Posted by Market Analysis at 10:24 AM 0 comments

Labels: 28-Dec-2007, Share Market

Stock-Watch

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

NMDC (+597), Everonn Systems (+92), XL Telecom (+27), RIL (+2), Syngenta India (+4),

Videocon Ind. (+62), Bharat Electronics (+43), JSW Steel (+51)

Posted by Market Analysis at 10:08 AM 0 comments

Labels: 28-Dec-2007, Share Market

Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

Wanbury (+6), Spice Communication (+1), Parle Software (+5), Mah. Seamless (+3), U Flex (+7),

Amtek India (+4), Essar Oil (+6), Infotech Enterprise (+3), Sona Koya Steearing (+2),

Classic Diamond (+4), Indusind Bank (+5), Power Grid (+1)

Posted by Market Analysis at 10:06 AM 0 comments

Labels: 28-Dec-2007, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

ONGC (+3), Tata Steel (+18), SBI (+11), Hero Honda (+1), Zydus Cadila (+2), CMC (+97),

Bank of Baroda (+16), HDFC Bank (+49), ACC (+3), TCS (+3), REL (+28),

Hindalco (+3), Wipro (+10), IOC (+32)

Posted by Market Analysis at 10:03 AM 0 comments

Labels: 28-Dec-2007, Share Market

Speculative Scrips

Excellent Performance of our Last Recommendations:

(From Intra Day High Rate)

Swnwari Agro (+6), ITI Ltd. (+2), SIL Investment (+5), Jhunjhunwala Vanaspati (+9),

Inducto Steel (+2), VLS Finance (+2), Deccan Gold (+5), Gemini Communication (+21),

Rajeshwari Foundation (+1), VBC Ind. (+1), Yashraj Security (+1), S.Kumar Nat. (+3)

Posted by Market Analysis at 10:00 AM 0 comments

Labels: 28-Dec-2007, Share Market

Thursday, December 27, 2007

: Daily Market Outlook:27th December, 2007 (Thursday)

MARKET GAVE A THUMPING REPLY TO THE BEARS BY RALLYING ONE SIDED FOR THE PAST TWO DAYS. JUST IMAGINE THE HOW MUCH WILL BE THE BEAR SQUEEZE, IF THIS RALLY CONTINUES NON STOP ON THURSDAY.

YESTERDAY, EVERONN SUGGESTED HIT THE UPPER CIRCUIT 10%, REL WAS ON FIRE, SO WERE CAIRN INDIA AND L&T.

SENSEX RESISTANCE AT 20498-20827-21067. SUPPORT AT 20014-19940-19780.

NIFTY RESISTANCE AT 6049-6185-6274. SUPPORT AT 6025-5985-5920.

Posted by Market Analysis at 10:15 AM 0 comments

Labels: 27-Dec-2007, Share Market

Stock-Watch

Stock-Watch

Santa Rally to Continue

&

Will lead the markets

to all time high

Fantastic Performance of our Last Recommendations:

(From Intra day High Rate)

M & M (+11), Rolta (+20), BHEL (+73), L & T (+109), Cairn India (+7),

Global Broad Cast (+81), Tata Steel (+31), Gail (+17), Marg Construction (+6),

Unitech Ltd. (+3), Bhushan Steel (+152), House of Pearl (+4), Satyam Computer (+5),

GMR Infra (+8), DLF (+41), Adani Enterprise (+47)

Posted by Market Analysis at 10:07 AM 0 comments

Labels: 27-Dec-2007, Share Market

Funda-Picks

Superb Performance of our Last Recommendations:

(From Intra Day High Rate)

RPL (+6), Jai Prakash Hydro (+5), Arvind Mills (+4), Tata Chemicals (+26), Power Grid (+4),

MRPL (+3), Sujana Towers (+9), RCF (+6), Ennore Foundation (+14), GNFC (+15),

Nagarjuna Construction (+15),� Sona Koya Steering (+4)

Posted by Market Analysis at 10:05 AM 0 comments

Labels: 27-Dec-2007, Share Market

Technical Share

Extra ordinary Performance of our Last Recommendations:

(From Intra day High Rate)

Tata Motors (+23), HCL Info (+17), BPCL (+30), Tata Power (+54), Dabur India (+2),

Ranbaxy (+3), SBI (+70), Sterlite Ind. (+25), Reliance Energy (+45), Parsvnath Dev. (+35),

NDTV (+24), ACC (+2), Escort (+4)

Posted by Market Analysis at 10:03 AM 0 comments

Labels: 27-Dec-2007, Share Market

Speculative Scrips

Excellent Performance of our Last Recommendations:

(From Intra Day High Rate)

Assam Company (+2.75), VLS Finance (+2), Nocil (+2), Spice Communication (+5),

Facor Steel (+1), Andrew Yule (+3), Ras Propack (+1),

Tutis Techno (+1), Networth Stock Broking (+2)

Posted by Market Analysis at 10:00 AM 0 comments

Labels: 27-Dec-2007, Share Market

Wednesday, December 26, 2007

: Daily Market Outlook : 26th December, 2007 (Wednesday)

MARKETS TOOK A GOOD TURN. NIFTY AND SENSEX BOTH CLOSED ABOVE

CRITICAL LEVELS. OUTLOOK HAS TURNED POSITIVE.

SENSEX RESISTANCE AT 20032-20498-20827. SUPPORT AT 19515-19260-18886.

NIFTY RESISTANCE AT 6049-6185-6274. SUPPORT AT 5920-5750-5676.

The markets likely to

Knock 20,000 Mark

Posted by Market Analysis at 10:49 AM 0 comments

Labels: 26-Dec-2007, Share Market

Speculative Scrips

Posted by Market Analysis at 10:42 AM 0 comments

Labels: 26-Dec-2007, Share Market

Friday, December 21, 2007

: Daily Market Outlook:20th December, 2007 (Thursday)

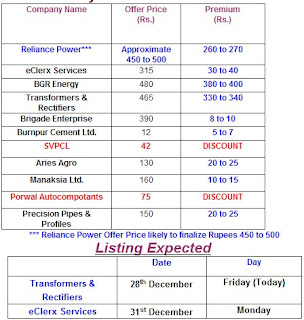

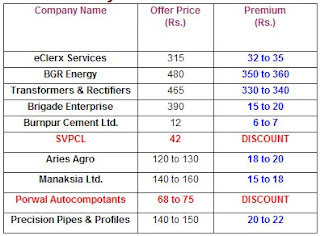

For Latest IPO News & Grey Market Premium

(Dt. 21st December, 2007)

Down the scroll to

Primary Market Column

Buzzing stock

BUY BUY BUY BATLIBOI

Equity: 13.5 Cr, BSE Code: 522004, CMP: 87.9

BATLIBOI @ 87 / 88 Target : 96 to 98

Batliboi, one of Indias oldest machine tool & engineering companies, has reported impressive performance for Q2 FY 2008. Batliboi is a leader in textile humidification systems, which are used to maintain moisture during the spinning process. With abolition of quota regime, textile industry is on capacity expansion spree with heavy investments coming in spinning segment. As spindlage capacity expands, demand for these systems will continue to rise over next couple of years.

Batliboi, being a leading player with 35% market share, is expected to be one of the biggest beneficiaries of this upward capex cycle in textile industry. Machine tool division is another core business. To augment growth of this division, company acquired 100% stake in Quick mill (QM) Inc, Canada for Rs 26 crore. QM is in special purpose machine tools with presence in niches of large area CNC Gantry and Bridge Type Milling & Drilling Machines catering to customers manufacturing heat exchangers, heavy equipment (customer Caterpillar), fabricated steel, aerospace (customer - Boeing), dies & moulds, bridge building machinery and automotives. QM enjoys 75% market share in heat exchangers in North America. Acquisition is win-win situation for both companies as they get access to each others market. Batliboi has added advantage because it will act more as an outsourcing base for QM.

Besides this, it has also acquired 70% stake in AESA France (CY 2006 sales Rs 71 crore; Loss of Rs 7 crore) in Industrial Air Engineering for Rs 9 crore. Sales and NP for year ended 06 07 were 128.1 Cr & 34.9 Cr. Sales and NP for latest Quarter 13.2 Cr & 2.8 Cr.

Posted by Market Analysis at 9:59 AM 0 comments

Labels: 21-Dec-2007, Share Market

Latest Grey Market Premium Dt. 21-12-07

Posted by Market Analysis at 9:57 AM 0 comments

Labels: 21-Dec-2007, Share Market

Speculative Scrips

Posted by Market Analysis at 9:50 AM 0 comments

Labels: 21-Dec-2007, Share Market

Bhilwara Energy pre-IPO placement likely in Feb '08

Riju Jhunjhunwala, Rajasthan Spinning & Weaving Mills has informed CNBC-TV18 that Bhilwara Energy will go for a pre-IPO placement & IPO in the next 4-5 months. The pre-IPO placement likely in February 2008, Jhunjhunwala said. The company is looking to raise USD 350-400 million via pre-IPO and IPO, he added. Bhilwara Energy will have 1800-2000 MW hydro capacity in the next 3-4 years, he said.

Excerpts from CNBC-TV18’s exclusive interview with Riju Jhunjhunwala:

Q: Can you start off by telling us a little bit about the plans on Bhilwara Energy and what happens to RSWM stake?

A: Bhilwara Energy is basically the power company of the group. It focuses only on hydropower. We have one project that is operational; it is a 100 megawatts project. Another 200 megawatts is in final stages of completion and will start next year.

Over and above this, we have more than 1,600 megawatts in the pipeline, which we will start construction over a period of now to the next two-three years. So, the next five years Bhilwara Energy, we really see it as a 1,800 to 2,000 megawatts hydro-only company.

Over there, the plans of fund requirements are huge. So, in the next 3-6 months, we are really planning something over there on how to get the first round of funding for Bhilwara Energy. RSWM holds a 26% stake in that, the balance is held by other group companies - HEG and the other promoter firms.

So, they should really see a value unlocking as and when that happens.

Q: You must have done some internal studies on how you value Bhilwara Energy as a company. Does it look like the most likely capital-raising road or the first step could be an IPO?

A: Most definitely; we are very keen to look at the possibility of an IPO. In fact we are already talking to some people now. We will probably be doing this in two stages, starting off with the pre-IPO stage and then finishing it off with an IPO - all within the next 3-6 months. The total fund requirement for our initial 18 months would be around USD 350-400 million, which we plan to split between the pre-IPO and the IPO of 30:70 kind of a ratio.

Valuations are anything, whatever deserves in the power sector today. We are trying to look at the pricing and all of that as of now.

Q: But still you would have some initial thoughts, leading up to the pre-IPO placement?

A: Three months back, we completed a process of private equity to New York Life and Wachovia Bank. That was done at an equity valuation of around Rs 1,400 crore for this company. At that time this company was more or less a 1,200 megawatt company. A lot has happened for us in the last six months, including the sector and our own projects that we have bagged. We expect it to be in multiples of that - without going into the exact number, definitely, significantly higher than that valuation.

Q: How much stake dilution does this involve for RSWM and for HEG?

A: The total promoter holding in Bhilwara Energy is around 92% today and anywhere between 15-20% of a stake dilution in phase one would be a comfortable number there. So, proportionately the stakes of these companies would also go down.

Post-IPO, we expect to hold around 20-21% of this company in RSWM.

Q: You would make the pre-IPO placement to the same investors, New York Life or Wachovia Bank or have identified some other investors?

A: That process will start now - the process of selecting the pre-IPO. Obviously, they have the right of first refusal as per the agreements. But then we are open to looking at other investors as well.

Q: What is happening with the core business; we understand you want to expand into the retail side as well?

A: Retail is not something that we are looking at in RSWM. It is more of a yarn play over there. Within yarn, we are amongst the top three players in India and we have significantly ramped up capacity over there, the effect of which will start coming in now.

All our expansions are now complete, including our 46 megawatt thermal power plant which is in RSWM as a captive generation. That has started commercial production just about last month. Come January, when the plant stabilises, you will see tremendous benefits on the cost reduction side coming on to RSWM itself and add it with the expanded capacity.

So, next financial year, we expect RSWM’s core business itself to give us very good jumps compared to the last one or two years. With the market scenario slightly improving in the textile side, we have gone through a bad patch over the last 6-7 months, but things seem to be changing now.

With that happening, I am sure RSWM core business itself for us is looking quite interesting as well.

Q: By when do you think this whole process will be completed: the pre-IPO and the IPO in 2008?

A: Pre-IPO, we are really targeting the month of February - completing the pre-IPO process. And IPO, I am not really in a position to say right now - whatever time it takes for the approval from Sebi. But we are working it at our end quite aggressively. As soon as possible, we would like to do that as well.

Posted by Market Analysis at 9:48 AM 0 comments

Labels: Market News

Thursday, December 20, 2007

: Daily Market Outlook: 20th December, 2007 (Thursday)

WE WERE BANG ON THE TARGET WHEN SENSEX & NIFTY TOOK SUPPORT AT EXACTLY THE

SAME LEVELS MENTIONED 18884 & 5665,

WHAT MORE U WANT WHEN THERE IS PANIC ALL AROUND.

SENSEX RESISTANCE AT 19206-19274-19397. SUPPORT AT 18965-18884.

NIFTY RESISTANCE AT 5823-5874-5930-5988. SUPPORT AT 5709-5677-5594.

Posted by Market Analysis at 10:04 AM 0 comments

Labels: 20-Dec-2007, Share Market

Speculative Scrips

Posted by Market Analysis at 9:52 AM 0 comments

Labels: 20-Dec-2007, Share Market

Manaksia IPO subscribed 9 times

Manaksia IPO subscribed 9 times

Manaksia, a multi division and multi location company focusing on manufacturing of value added metal products and metal packaging products, has subscribed 8.79 times, according to data available on NSE website.

The public issue received bids for 13.92 crore equity shares as against 155 lakh shares on offer.

Big support was seen from qualified institutional investors, their reserved portion subscribed 13.7 times followed by retail and HNIs with 5.09 times and 2.72 times, respectively.

Investors Times

Qualified institutional buyers - 13.70

Non institutional investors - 2.72

Retail individual investors - 5.09

Employee Reservation - 0.05

Total - 8.98

The company had entered capital market with a public issue of up to 15,500,000 equity shares of Rs 2 each for cash at a price band of Rs 140 to Rs 160 per equity share.

The total issue would constitute 22.29% and net issue 22.15% of the fully diluted post issue paid up capital of the company, respectively.

The company intends to use the net proceeds of the issue for expansion of metals business by purchase of capital equipment, prepayment of certain term debt and for general corporate purposes. The expansion of metals business includes addition of certain equipments for de-bottlenecking to aluminium rolling line at Haldia is aimed at production of higher value added products as well as improving efficiency of its present production.

ICICI Securities is the book running lead manager for the issue. The equity shares of the company are presently listed on the CSE and the equity shares offered through this public issue are proposed to be listed on the BSE, NSE and the CSE.

Posted by Market Analysis at 9:50 AM 0 comments

Labels: Market News

Stocks in news: HEG, IFCI, Deccan Aviation

Stocks in news:

Board meetings:

HEG board to consider issue of convertible warrants on preferential basis to promoters

United Phosphorus on transfer of Haldia Division of subsidiary SWAL Corporation

Zicom Electronic on issue of warrants to non-promoters on preferential basis

Ex-dividend:

Ahmednagar Forgings (Rs 2/sh), Amtek Auto (Rs 3/sh), Amtek India (Re 1/sh) and Shri Lakshmi Cotsyn (Rs 2/sh)

Indian ADRs:

VSNL up 22% and MTNL up 4%

IFCI stake sale called off, management control reason behind deal being called off: Sources

IFCI not to pursue stake sale talks with any bidders, says scraps entire plan to sell 26% stake

Kingfisher to merge into Air Deccan; merged co to be subsidiary of UB Holdings; Deccan to remain listed, to be renamed Kingfisher Airlines later

Deccan, UB Borads to meet in Jan to finalise merger; Deccan’s helicopter business to be demerged

Kingfisher-Deccan combine to have highest market share

Bajaj Hindusthan to exercise entitlement of 5.7 cr shares at Rs 50/sh in Bajaj Hindusthan Sugar; to make open offer

NSE F&O curb

New in curb: Adlabs, Triveni

Already in curb: Aptech, Essar Oil, Gitanjali Gems, IFCI, Nagar Fert, Power Grid

Out of curb: Alok Industries

Madras HC restrains TVS from booking; distribution or selling recently launched 125cc Flame - ET

Manaksia IPO subscribed 8.79 times, Aries Agro IPO subscribed 7.62 times

Precision Pipes IPO closes today; subscribed 0.69 times till now

Porwal Auto IPO closes today; subscribed 0.83 times till now

PSL receives gas pipe supply order worth Rs 125 cr

Welspun India buys 76% stake in Portugal's Sorema; enterprise value Rs 60 cr

Andrew Yule

Gets BIFR approval for Rs 491 cr revival package: NW18

Says to divest 26% stake in Tide Water: NW18

M&M to hikes prices by up to Rs. 10,000 from Jan 1

Thomas Cook says:

No plans to go in for private placement of equity

Rights issue likely to be offered in second half of 2008

Nicholas Piramal forms JV with Arkray Inc, Japan for marketing diagnostic products in India

Prime Securities board meet on Dec 27 to considerWithdrawal of

special resolution for buy-back

Increase in FII investment limit

Issue of shares / warrants on preferential basis

Phoenix Mills board approves splitting FV of shares from Rs 10 to Rs 2

RIL, Tata Chem in talks for KG basin gas sale, deal only if HC lifts stay on third-party sale - ET

Tata Steel in talks with Vale, world’s largest producer of iron ore to set up steel slab plant in Brazil - BS

MRF plans Rs 500 cr new facility in TN - BS

NTPC scouts for USD 1bn acquisition overseas, deal to open up opportunities to secure coal, gas - Mint

Mudra Lifestyle board approves

setting up of Spandex/elastomeric yarn project worth Rs 300 cr

Issue of 30 lakh warrents to promoters at an effective price of Rs 120/sh ( CMP 107)

Issue of FCCB/ADR/GDR of Rs 200 cr

Posted by Market Analysis at 9:41 AM 0 comments

Labels: Market News

Wednesday, December 19, 2007

: Daily Market Outlook:

19th December, 2007 (Wednesday)

MARKETS IN CORRECTION MODE AND THE NIFTY EXACTLY TOOK SUPPORT AT THER LEVEL MENTIONED YESTERDAY AROUND 5710, WHICH IS VERY CRITICAL FOR THE MEDIUM TERM UPMOVE TO BE SUSTAINED.

SENSEX RESISTANCE AT 19225-19319-19375-19461. SUPPORT AT 19009-18961-18884.

NIFTY RESISTANCE AT 5787-5815-5895-5935. SUPPORT AT 5710-5665-5594.

Posted by Market Analysis at 9:55 AM 0 comments

Labels: 19-Dec-2007, Share Market

Speculative Scrips

Posted by Market Analysis at 9:45 AM 0 comments

Labels: 19-Dec-2007, Share Market

Manaksia IPO subscribed 2.37 times

Manaksia, a multi division and multi location company focusing on manufacturing of value added metal products and metal packaging products, will close for subscription today. It was subscribed 2.37 times, till yesterday, according to data available on NSE website.

The public issue received bids for 3.67 crore equity shares as against 155 lakh shares on offer.

Support was seen from qualified institutional investors, their reserved portion subscribed 4.6 times.

The company had entered capital market with a public issue of up to 15,500,000 equity shares of Rs 2 each for cash at a price band of Rs 140 to Rs 160 per equity share.

The total issue would constitute 22.29% and net issue 22.15% of the fully diluted post issue paid up capital of the company, respectively.

The company intends to use the net proceeds of the issue for expansion of metals business by purchase of capital equipment, prepayment of certain term debt and for general corporate purposes. The expansion of metals business includes addition of certain equipments for de-bottlenecking to aluminium rolling line at Haldia is aimed at production of higher value added products as well as improving efficiency of its present production.

ICICI Securities is the book running lead manager for the issue. The equity shares of the company are presently listed on the CSE and the equity shares offered through this public issue are proposed to be listed on the BSE, NSE and the CSE.

Posted by Market Analysis at 9:43 AM 0 comments

Labels: 19-Dec-2007, Market News

Rel Comm acquires telecom license in Uganda, stock gains

At 1:55 pm, Reliance Communications was quoting at Rs 725, up Rs 7.20, or 1%. It has touched an intraday high of Rs 730 and an intraday low of Rs 710.15.

According to sources the company has acquired telecom license in Uganda to offer GSM services and is likely to invest USD 200 million, reports CNBC-TV18.

It was trading with volumes of 774,757 shares. Yesterday the share closed down 5.55% or Rs 42.15 at Rs 717.80.

Posted by Market Analysis at 9:42 AM 0 comments

Labels: 19-Dec-2007, Market News

Reliance Petroleum among major gainers

It was trading with volumes of 18,292,412 shares. Yesterday the share closed down 6.05% or Rs 13.40 at Rs 208.25.

Posted by Market Analysis at 9:39 AM 0 comments

Labels: Market News

Tuesday, December 18, 2007

Speculative Scrips

Posted by Market Analysis at 9:46 AM 0 comments

Labels: 18-Dec-2007, Share Market

Monday, December 17, 2007

Speculative Scrips

Posted by Market Analysis at 9:40 AM 0 comments

Labels: 17-Dec-2007, Share Market